Typically, EBITDA is defined as a profitability statistic, but that is often misleading because a company might have a net loss while still having a positive EBITDA. Therefore, EBITDA can be defined as a performance metric.

When comparing the financial performance of companies in different industries with different capitalization structures and different tax countries, EBITDA is the most appropriate tool to use. This is because EBITDA encapsulates the effects of capital expenditures, taxes, and interest payments.

EBITDA might also mask symptoms of financial distress, such as high debt and insufficient cash flow. As a result, it should only be considered one component for determining a company’s financial health.

What is EBITDA?

EBITDA (earnings before interest, taxes, depreciation, and amortization) is a commonly used metric for determining a company’s operating profitability. While net income after all costs, including taxes and non-operating expenses, is the correct measure of profitability, EBITDA can provide a clearer picture of a company’s capacity to generate cash from its core operations.

EBITDA is calculated by taking earnings and subtracting amounts paid for interest on loans, payments to all jurisdictions where a corporation owes taxes, and capital asset depreciation and amortization deductions.

Important points to note

- EBITDA critically excludes effects or impacts that can potentially distort Taxes, interest, and depreciation & amortization.

- EBITDA can help business leaders, investors, and lenders compare companies against other firms around the globe.

- EBITDA can obscure excessive debt, weak cash flow, and expensive borrowing rates.

- EBITDA does not indicate whether a company’s financial position is long-term, i.e whether it can service the existing debt while investing in the business.

- EBITDA should always be used with other financial measures when evaluating a firm for investment.

EBITDA in details

EBITDA measures a company’s profitability that excludes the potentially distorting effects of taxes, interest on debt, and capital expenditure deductions. The following expenses are removed from EBITDA but are included in the calculation of net income:

- Interest paid on bonds, bank loans

- Taxes paid.

- Depreciation occurs when the value of tangible assets like real estate or industrial equipment decreases.

- Amortization through the depreciation of intangible assets such as patents and goodwill.

By removing these items from the equation, potential buyers, lenders, and investors will be able to assess the profitability of companies with vastly different capital structures and asset bases and those operating in other tax countries.

However, because interest and taxes are real business expenditures, and depreciated assets must eventually be replaced, EBITDA can create a deceptive image of a company’s robustness.

EBITDA does not comply with the US. Generally Accepted Accounting Principles (GAAP), and all companies do not report it. While EBITDA can be easily derived from the financial statements of a public corporation, it can also be utilized and evaluated by private companies.

EBITDA Calculations & Formula

EBITDA can be calculated in two different ways.

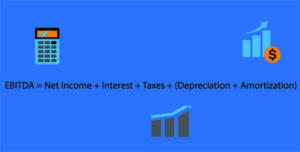

The first method begins with net income and subtracts interest on borrowed funds, such as bank loans and bonds issued, taxes paid, and the non-cash value of depreciation and amortization. This is how the formula is written:

All these items for calculating EBITDA can be found in public firms’ financial statements. The income statement usually includes net income, taxes, and interest. Depreciation and amortization are sometimes included on the income statement, although they’re usually found in the cash flow statement and/or the notes to the published accounts. Some businesses consolidate depreciation and amortization into a single line item.

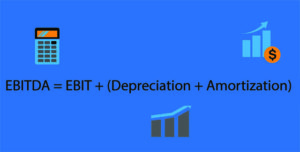

The second technique starts with EBIT (or operating income, the same as EBIT if no non-operating expenses or income exist) and subtracts fixed asset depreciation and intangible asset amortization. This is how the formula is written:

EBITDA Examples

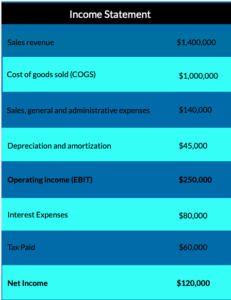

Example 1: Assuming that a company’s income statement appears as follows.

Then the calculation of EBITDA using the first method will be:

| EBITDA = Net Income + Tax Paid + Interest Expense + Depreciation & Amortization = $120,000 + $60,000 + $80,000 + $45,000 = $305,0000 |

However, operating income is displayed on the income statement in this instance. Therefore, the second way of calculating EBITDA is even easier than the first:

| EBITDA = Operating income + Depreciation & Amortization = $250,000 + $45,000 = $295,000 |

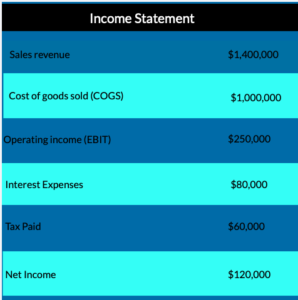

Example 2: Assuming that the income statement looks as below.

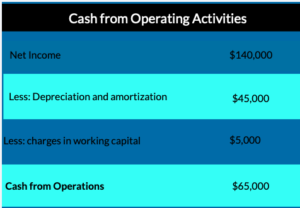

Depreciation and amortization are not shown individually on the income statement in this case. We’ll have to check the cash flow statement to get those figures. The following is shown in the first part of the cash flow statement:

To calculate EBITDA using the first approach, we add back depreciation and amortization from net income as shown on the cash flow statement. The income statement’s tax paid and interest expense are added back in. As a result, the calculation is as follows:

| EBITDA = $140,000 + 45,000 + 80,000 + 60,000 = $325,000 |

Why you should use EBITDA for your business

EBITDA is a valuable metric to employ when comparing organizations with different capital arrangements. For instance, businesses that have taken on debt to acquire expensive fixed assets that management believes will lead to growth may have lower net income due to interest payments than companies with less debt. EBITDA eliminates the effect of interest, making it easier to assess a company’s underlying profitability. As a result, companies in highly indebted, capital-intensive industries like telecoms frequently utilize EBITDA as a crucial performance indicator. This is because EBITDA does not include interest on loans; it allows businesses to claim more considerable earnings than their net income would suggest. However, this is simply one of the reasons why heavily leveraged corporations might want to publish EBITDA.

Since EBITDA does not include depreciation and amortization, companies with many aged pieces of equipment that need to be replaced soon or office real estate with lost value can downplay their significance. Because depreciation and amortization are non-cash expenses that have no bearing on working capital, incorporating them distorts the findings.

Similarly, an EBITDA calculation allows businesses with significant tax liabilities or those situated in high-tax areas to deduct the actual cost of local, state, and federal taxes. The corporation may choose earnings before interest, depreciation, and amortization in this situation (EBIDA).

Perhaps, if a company has big losses or sales decreases or has benefited from extensive tax rebates or credits, it may have a negative income tax burden, making EBIT a more appealing performance statistic.

EBITDA flaws:

GAAP does not recognize EBITDA, therefore, it is of limited use in presenting a complete view of a company’s performance.

Investors who want to compare two or more public firms can use EBITDA since it allows them to drill down into financial reports to check if the metric is making business performance look better than they are.

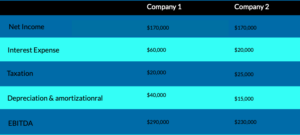

Consider the following two businesses with identical business lines but different financing structures. Both have a net income of $170,000; however, their EBITDA is vastly different:

The higher interest expenses, depreciation, and amortization of Company 1 could indicate that it has taken out a large loan to invest in assets. On the other hand, the higher interest expenses could suggest that the company has a lower credit rating and pays higher interest rates than company 2. Company 2, on the other hand, may be suffering from under-investment due to its lower EBITDA and lower interest expenses, depreciation, and amortization.

What Is a Proper EBITDA?

In general, the larger the EBITDA, the more profitable the business. However, EBITDA varies by industry; hence executives who want to use it to assess their competitive situations should compare their EBITDA to that of other companies in the same sector and location — and even then, proceed with caution.

Leveraged Buyouts’ EBITDA History

In the 1980s, EBITDA became popular as a tool for investors specialized in leveraged buyouts, usually of ailing businesses. In a leveraged buyout, the investor finances an acquisition with debt, then loaded onto the acquired company’s balance sheet. EBITDA helps investors figure out a company’s underlying profitability, so they use it to see if a potential acquisition would generate enough profit to service the new debt they planned to add to its balance sheet.

Since then, EBITDA has become a popular metric for assessing business performance. Highly leveraged companies can utilize it to persuade investors and lenders that their core businesses are profitable and that they can service their loans. It can convince investors to keep cash flowing in fast-growing firms with substantial but short-term cash needs and potentially good profitability.

Modern accounting with EBITDA

As aforementioned, EBITDA is unnecessary in business financial statements because it does not comply with the US Generally Accepted Accounting Principles (GAAP). Many organizations still report EBITDA, but it does not replace U.S. GAAP-compliant financial indicators.

How EBITDA is used in Financial Modeling

Business managers create financial models, investors, and analysts to help them forecast a company’s expected future performance based on its past performance. EBITDA can be projected, estimated, or forecasted using financial models.

EBITDA is also the starting point for several other critical financial metrics, including the debt-to-EBITDA ratio and EBITDA coverage, which are indicators of the company’s capacity to service its debts which is a measure of the company’s value.

How to Boost EBITDA

Increasing sales revenue, lowering sales costs, or reducing operating costs — or combining the three — are the three basic strategies to enhance EBITDA.

If your clients are loyal to your brand, boosting pricing is one strategy to improve sales revenue. Alternatively, you might lower your sales costs by switching to a lower-cost supplier. Many companies boost their EBITDA by reducing operating costs, such as decreasing administrative staff, streamlining company procedures, and selling unproductive business lines.

EBITDA’s Advantages and Disadvantages

Advantages

EBITDA may provide a clear view of a company’s profitability by excluding taxes and how assets are financed and expensed. It’s straightforward to calculate and comprehend. It may be applied to organizations with a wide range of capital structures and across numerous tax countries, allowing business managers to better understand their competitors and investors to assess companies across broad industries.

EBITDA is also essential for companies purchased through leveraged buyouts and have a lot of debt. Because of the requirement to service that debt, bottom-line profits are typically lower than if the capital structure was less debt-laden. EBITDA can help these businesses focus on the underlying profitability of their operations.

When looking for a buyer, a company would want to focus on EBITDA rather than net income. When a firm is bought by an investor or another company, its capital structure usually changes dramatically. Debt is frequently turned into equity, written off, or restructured. Acquirers may relocate a company’s headquarters to reduce taxes, as well as revalue or sell the company’s assets. As a result, potential purchasers want to see the company’s core profitability without considering the capital structure and asset base.

Disadvantages

EBITDA may not provide a comprehensive view of a company’s financial performance. In fact, because it excludes the consequences of debt, taxes, and issues connected with both tangible and intangible assets, it can be misleading. Overemphasizing EBITDA may divert attention away from red flags, including high debt, high costs, insufficient cash flow, and diminishing sales.

Because EBITDA is often higher than net income at the bottom line, valuing a firm based on EBITDA might give the impression that it is more valuable than it appears based on other indicators.

EBITDA’s Limitations

Despite EBITDA being famous, it has a number of drawbacks. These are some of them:

- Some investors use EBITDA to forecast cash flow. However, it does not account for changes in working capital, which can significantly impact cash flow. As a result, a company’s cash flow can be negative while its EBITDA is positive.

- EBITDA might mask a financially unsustainable situation. Even with fast-expanding debt, significant borrowing costs, and negative cash flow, a company’s EBITDA can rise.

- Excluding the consequences of capital expenditures like depreciation and interest may provide the false impression that the company’s assets are free.

- Non-recurring expenses, such as asset write-downs, are sometimes excluded from EBITDA. Although the intention is to create a more accurate comparison with similar companies, this method can give a false sense of performance over time. For example, a corporation might write off or sell assets every year for several years, resulting in losses on the bottom line. However, because adjusted EBITDA excludes these losses, the statistic may provide a too optimistic picture of profitability.

Due to these restrictions, EBITDA should be used with other performance indicators such as free cash flow, net debt, and profit margins.

EBITDA Frequently Asked Questions

Q: What is the difference between EBIT, EBT, and EBITDA?

A: EBT, EBIT, and EBITDA are related performance indicators. Here’s how they stack up:

- EBT eliminates the impact of taxes on a business’s bottom line. This allows business owners to evaluate profitability without being swayed by taxes, which are beyond their control and are susceptible to change.

- Both EBIT and EBITDA remove the impact of capital structure on a company’s profitability. This makes organizations with a lot of debt and/or interest charges appear more lucrative. Depreciation and amortization costs associated with capital expenditures are also removed from EBITDA. As a result, EBITDA makes enterprises with big asset bases appear more profitable, mainly if they are debt-financed.

Q: What is the difference between EBITDA and operating cash flow (OCF)?

A: EBITDA is frequently confused with operating cash flow (OCF). However, there is a significant distinction between the two measures. EBITDA is a measure of a company’s profitability, whereas OCF measures cash flow from operations. EBITDA does not incorporate changes in working capital, whereas OCF does. In some cases, a company’s EBITDA may be positive, yet its OCF is negative.

Q: What is the difference between EBITDA margin and EBITDA to sales ratio?

A: The EBITDA margin measures a company’s profitability as a percentage of sales revenue. It is also referred to as “EBITDA to sales ratio.”

Q: What is the ratio of EBITDA to sales?

A: It is a synonym for EBITDA margin.

Q: What is the similarity between EBITDA and gross profit?

A: Gross profit is not the same as EBITDA. After removing the cost of sales, gross profit is a primary measure of raw profit from revenue, but EBITDA additionally includes operating expenses. In most cases, EBITDA is less than gross profit.

Q: What exactly is the EBITDA coverage ratio?

A: The EBITDA-to-interest coverage ratio, often known as EBITDA coverage, measures a company’s capacity to cover interest expenses with profits. Lenders generally use it to determine how much debt a business can handle. Lenders may impose a condition on loans that the company maintains EBITDA coverage above a certain threshold, such as 2.5.

Q: What is the ratio of net debt to EBITDA?

A: The ratio of net debt to EBITDA is a measure of a company’s debt. It shows how long it will take the company to pay off all its debt if both the debt and EBITDA remain constant. As a loan condition, lenders frequently impose a maximum net debt to EBITDA ratio, such as 3.5.

Q: What is the EBITDA multiple?

A: The EBITDA multiple is a metric for determining a company’s worth. It is a financial ratio that compares the enterprise value (EV) of a company to its profitability.

Q: What’s the difference between EBITDA and profit margins?

A: Three types of profit margins are recognized by US GAAP:

- Gross profit margin

- The margin of net profit

- Profit margins on operations

The EBITDA margin isn’t recognized in US GAAP because it isn’t a US GAAP metric. In addition to the three U.S. GAAP measurements, many businesses find it a useful measure of profitability.

Q: What is the relationship between net income and EBITDA?

A: Taxes, interest costs, depreciation, and amortization are all included in net income, whereas EBITDA does not. EBITDA can be significantly higher than net income in organizations where these expenses are enormous. As a result, some businesses utilize EBITDA as their primary profit indicator. The items that EBITDA does not include, on the other hand, are actual expenses that can expose a company to shocks. As a result, analysts frequently compare EBITDA and net income.

Q: What is the difference between operating income and EBITDA?

A: Operating income and EBITA may be the same for some companies, but that isn’t always the case. Operating income includes depreciation and amortization, but EBITDA does not. As a result, EBITDA is usually larger than operating income for enterprises with big asset bases.

Q: What is adjusted EBITDA, and how does it differ from EBITDA?

A: Some organizations utilize adjusted EBITDA, which excludes non-recurring revenue or expenditure events and may include things found in the financial statements of peers in the same industry. The goal is to come up with a metric that can be directly compared to other businesses in the industry.

However, adjusted EBITDA might be misinterpreted to present a false impression of profitability because there is no universal definition of which costs should be included. The following are typical modifications:

- Non-operating revenue

- Profits or losses that have not yet been recognized.

- Expenses that do not have a monetary value.

- Gains or losses resulting from the sale of an asset.

- Expenses for litigation and fines imposed by regulators

- Depreciation of goodwill

- Asset write-downs

- Profits and losses in the foreign exchange market

What next?

Taking Your Business to the next step can only come to reality if you have the right expertise to deliver outstanding solutions. At Seibert Consulting Group, we specialize in delivering modern solutions to businesses that aim at taking full advantage of the eCommerce platform. We always customize our solutions to align with Your Business’ requirements and goals. Let’s start talking about your project and find out how we can help Your Business grow. Get in touch with us via our chatbot or email hello@seibertconsulting.com and via our direct line at 760-205-5440.