Technology companies introduced the first accounting software over 45 years ago, and it has continually evolved how accountants do their work. Paper ledgers and the basic tools that let bookkeepers crunch numbers were supplanted by computer-based systems.

With the innovation and advancement of cloud-based accounting solutions, accounting software made another big step forward. Like other cloud software, these technologies gave enterprises game-changing flexibility while lowering capital costs and utilizing human resources.

Cloud accounting has received considerable adoption because it offers advantages over past approaches to this vital business function.

What Is Cloud Accounting and How Does It Work?

Basic accounting operations, such as managing and balancing the books, are performed using software that lives in the cloud and is frequently supplied in an as-a-service format. Within the application, staff or third-party accountants can manage accounts payable, accounts receivable, the general ledger, and much more. Cloud accounting software, like other cloud-based systems, works on a cloud provider’s platform rather than on a local hard drive or server. Employees or third-party accountants do not require to be in a specific area to comprehend the financial state of the organization because they can access the resources they need via the internet.

Nearly 60% of U.S. businesses used cloud software to manage finance and accounting as of 2019. Furthermore, only 22% of organizations do not plan to use cloud financial technology in the future, a drop of a few percentage points from the previous year.

What’s the Difference Between Cloud Accounting and On-Premises Accounting?

Early accounting systems were only available on-premises, which meant that it was on the hard drives of the accounting team’s PCs or a company-owned and-maintained server. Anyone wishing to use the software needs a computer with the appropriate software installed or to be in close proximity to the server. Furthermore, because all data was stored locally rather than in the cloud, it was susceptible to lose or damage.

While early on-premises accounting software provided significant benefits over manual techniques such as paper ledgers, these systems lacked the flexibility and scalability that cloud software provided. For example, the company was in charge of software upgrades, which might be costly and time-consuming. This is a significant distinction from software-as-a-service (SaaS) systems, which are a popular type of cloud software in which the software provider handles all maintenance and upgrades while consumers pay an annual licensing cost.

It’s crucial to remember that SaaS accounting software is only one sort of cloud accounting software. Multiple firms share the same infrastructure on the public cloud with a multi-tenant SaaS cloud accounting system. Companies can also use the private cloud, which means their software is hosted on dedicated servers. Hybrid versions that use both public and private clouds are also available. It’s worth noting that with these private cloud and hybrid deployment models, the organization takes on more obligations rather than the provider.

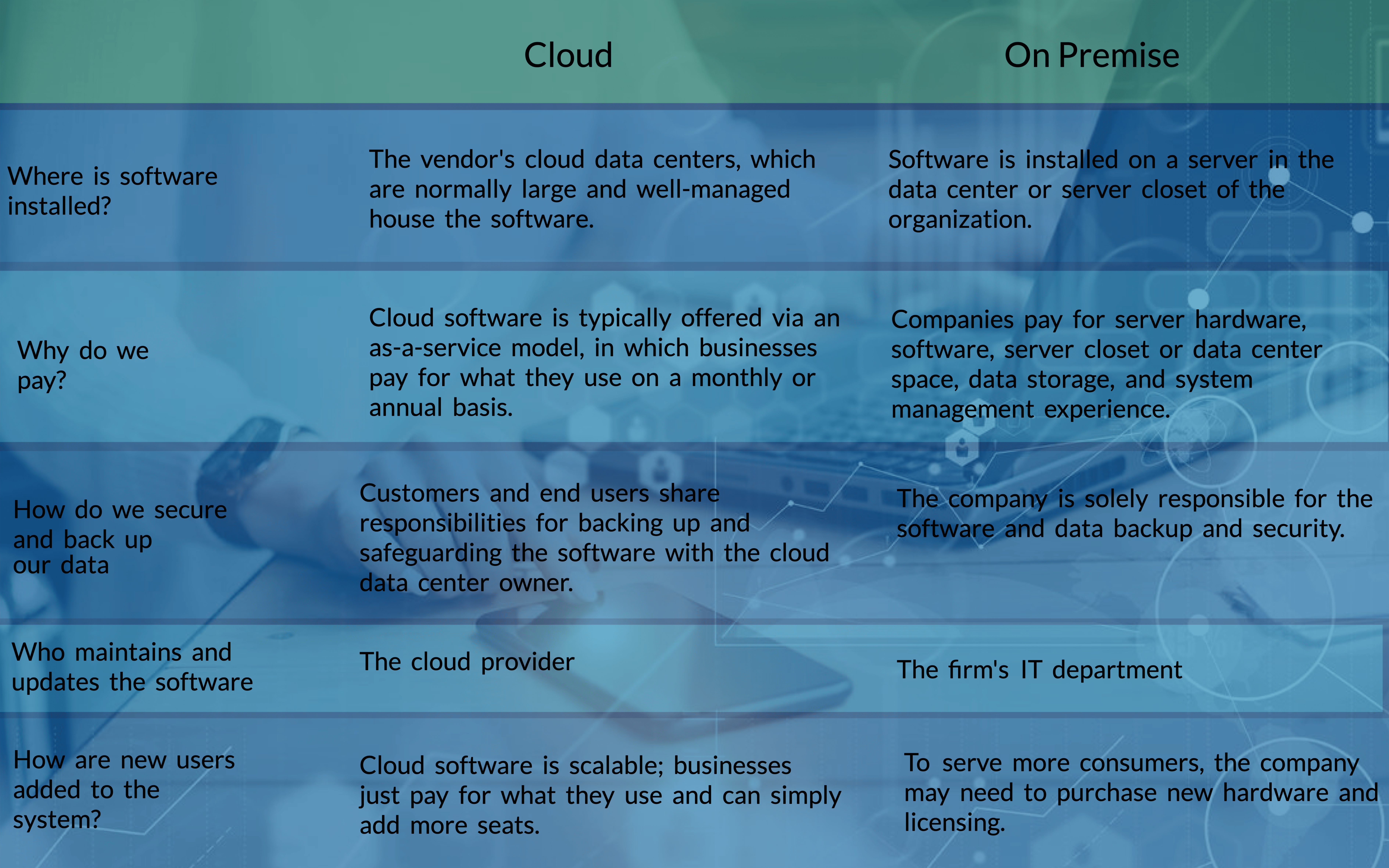

Cloud vs. On-Premises Software

What is the Process of Cloud Accounting?

Accountants, controllers, CFOs, and other relevant parties receive login credentials for the system and access it via a web browser on a laptop, smartphone, or tablet in cloud accounting. To boost the User eXperience (UX) on mobile devices, the supplier may offer a mobile app.

All transactions are automatically posted to the correct digital ledger because the software is often integrated with the company’s bank accounts. Users frequently have a home dashboard that shows the financial data that is most important to their jobs, such as available cash, invoices due in the next five days, and past-due client payments. As new data is received by the software, all numbers are updated quickly, and users can drill down into the data for more information.

Accounting is crucial to any enterprise resource planning (ERP) system. Therefore, financial planning and budgeting, inventory and order management, human resources (HR), customer relationship management (CRM), and other critical corporate operations are centralized on an ERP platform. This database integrates modules meant to handle many elements of the organization, allowing cross-functional operations to be supported, many of which must be linked to accounting. Payroll, purchase orders, and the on-hand inventory value, for example, must all be reported in real-time in the accounting system.

Cloud Accounting Software’s Advantages

The key advantages of cloud accounting software explain why it has quickly become the instrument of choice for many financial professionals. These advantages also demonstrate why cloud accounting is becoming the norm.

Automation: Transactions post automatically when bank accounts are linked to the accounting system, eliminating the need for time-consuming data entry or manual imports. Account reconciliations can also be automated with this software, which matches bank statements and invoices to ledgers to help you close the books faster. On user-defined dates, specific accounting software can also pay vendors and issue bills to clients.

Accessibility: As previously said, all a cloud accounting solution requires is an internet connection, a web browser, and login credentials. They can access the solution via mobile devices such as smartphones and tablets. To see information or execute tasks in the system, employees and other users do not need to be on a specific computer or in a given place. This also enables your accountant from a CPA firm, for example, to quickly locate all the data they require and notify leaders of any issues that demand their attention.

Lower overhead costs: Companies that employ cloud technology typically spend less than those that operate their IT stacks in-house. According to cloud research firm Datometry, more than 60% of IT leaders indicated cost reduction was their top priority. You don’t need to buy hardware or hire a massive IT staff to administer the system accounts for a large portion of the savings. The total cost of ownership is also reduced by avoiding updates and maintenance frequently, resulting in hefty payments from the vendor or a partner.

Data security: Top cloud software manufacturers’ security protocols are significantly more comprehensive than most firms can achieve with on-premises systems. Cloud services back up your data to numerous servers regularly, lowering the chance of a fire or natural disaster compromising your system and information. Because data is not kept on the device, anyone in your office cannot steal hard drives or gadgets containing necessary information. There’s also no need to share information through unsafe techniques such as flash drives or emails.

Scalability: Organizations can use cloud software to access virtually any computing power they require. They can add server capacity as the business, and its demands grow. If they desire additional capabilities, they do not need to acquire new hardware or make any other changes. Another significant benefit of outsourcing all infrastructure is this. Cloud accounting solutions can be adopted more quickly and at less cost across numerous locations or geographies.

Collaboration is facilitated by cloud accounting software because all data is accessible and readable by all authorized users. Because there is no single information gatekeeper, permissions can be altered to allow a marketing leader, for example, to examine sales figures from the previous quarter. Cross-departmental projects and collaboration are aided by visibility.

Sooner implementation: Because there are no servers to buy and set up and no IT staff to train, companies can usually get up and running with a cloud solution faster. Furthermore, leading suppliers have completed thousands of installations and established efficient, repeatable methods that will enable you to realize the new system’s benefits rapidly.

Traditional Accounting Software’s Challenges

While such advantages sound appealing, you may believe that your on-premises accounting software is still up to the task. What are you missing out on by continuing to use that system?

Expensive upgrades: On-premises systems are notorious for costly and lengthy upgrades that take longer and compel customers to reinstall or reprogram customizations. These projects’ expenditures tend to pile up quickly since they rarely proceed as planned. As a result, many businesses delay upgrading, limiting their ability to take advantage of new features and capabilities that their competitors may have.

Poor security practices: Backing up all the data in your accounting software is significant. Backups are costly and time-consuming to set up, so corporations only do it once in a while, if they do it at all. That means you risk losing weeks or months’ worth of critical data if a ransomware attack or natural disaster succeeds.

Traditional accounting software requires users to be on the company’s network or log into a VPN to use the system, which restricts where and how they can use it. This is inconvenient and costly because the company must purchase VPN or similar software. This may limit key stakeholders’ access to data that could influence their decisions and strategies.

End of Life (EOL): With cloud accounting becoming increasingly common, many on-premises accounting software providers are discontinuing support. This is a significant concern because if you’re using an end-of-life solution, you’ll be compelled to migrate to the cloud or take full responsibility for obsolete, unsupported on-premises software. Cloud accounting software is updated regularly and is unlikely to be retired.

When Is It Ideal for a Business to Use Cloud Accounting?

Given the numerous benefits of cloud accounting and its cheaper upfront expenses, many newer businesses choose it from the outset. Even entry-level accounting systems now have cloud versions, which may encourage clients to use them.

Finance and accounting are at the heart of everything a company does; it needs a mechanism to track transactions and assess its financial health at any given time. A business that does not follow basic financial practices will not last long and violate significant financial and tax restrictions. When a firm starts, it may manage its general ledger and other accounts using spreadsheets or other manual procedures. This strategy, however, is error-prone and time-consuming, and it frequently proves unsustainable.

All of these concerns are addressed by a cloud accounting system. Software is accessible for sole proprietorships to multinational corporations, making it a natural choice for almost any firm in any field.

6 Reasons to Use Accounting Software on the Cloud

Cloud accounting software enhances business operations hence allowing your firm to prosper. The following are some compelling reasons to migrate your accounting to the cloud:

Cheaper to operate: Owning and operating a cloud accounting system is often less expensive than doing it on-premises. There’s no need to buy hardware, and the company won’t have to worry about mounting expenditures from updates and upkeep because the provider will handle everything. Furthermore, the organization does not need to invest in VPN software or any other form of middleware that enables employees to operate remotely.

Expenditures are more predictable: Because the firm isn’t concerned with the costs indicated above, it’s much easier to estimate how much it will spend on the accounting solution each year. Everything is packaged into a single fee with SaaS, and the cost for additional customers or capabilities is obvious. This will prevent your IT spending from diverting to other parts of the company.

Make use of the most up-to-date technology: Users can benefit from more modern and new technologies that can bring extra business benefits if system upgrades are performed regularly and regularly. A small or medium business, for example, is unlikely to invest in machine learning or robotic process automation (RPA) on its own to improve the efficiency of its financial processes. However, an upgrade may provide such a feature, and the company could profit without spending additional money.

Best-in-class infrastructure: Leading cloud vendors service hundreds, if not tens of thousands, of businesses, and best-in-class infrastructure is required to support all of those customers. Their data centers provide unrivaled performance, security, and scalability. Because of the resources and experience necessary, most businesses cannot match the vendor’s capabilities in any of these areas on their own. However, these same firms can benefit from this infrastructure by purchasing accounting software from a reputable source.

Improved business continuity: Your accounting system’s data is extensive and vital, and losing it might be disastrous. Cloud software provides a security blanket because your data is stored on a remote server and backed up to data centers in other places. So, your firm may continue to run normally even if one of your data centers is destroyed by a storm or tornado. On-premises systems hosted on an in-house server don’t have this problem; with the cloud, it’s there from the start.

Unify your organization: Cloud accounting software can be the foundation for conducting your business on the cloud. There are cloud solutions available for every part of operations. Connecting these solutions, for example, allows you to track consumers as they progress from lead to paying client and then submit the transaction to the general ledger automatically. Employees may access information and make necessary modifications from anywhere once all systems are in the cloud.

Cloud Accounting Costs

Because it offloads considerable expenses to the provider, cloud accounting software is frequently less expensive than on-premises solutions. The organization doesn’t need to buy new hardware or hire more IT professionals to monitor and manage the system.

SaaS solutions charge an annual license price for access to their service, which varies per vendor. The licensing fee is usually calculated by multiplying the initial cost by the number of users and items used. A small products company, for example, would only require basic accounting software. In contrast, a subscription-based corporation with complicated billing operations might need an add-on module to meet revenue recognition criteria.

Thanks to SaaS’s modular pricing model, customers may pay only for what they need when they need it. As an organization grows and evolves, it is simple to add users or modules.

Comparably, hybrid cloud accounting solutions can have a perpetual license, similar to on-premises systems. Customers pay a hefty one-time charge for this license and maintenance and support for as long as they utilize it. The cloud provider will also charge hosting fees, often depending on the organization’s processing power.

Both hybrid and SaaS systems may charge a one-time implementation fee that varies depending on the system’s complexity and your specific requirements.

Cloud Accounting’s Future

As cloud adoption grows, it has become a center for technical innovation. There are a few technologies that could help you save even more time and money.

Machine Learning & Artificial Intelligence

Accounting software can benefit from artificial intelligence (AI) and, in particular, machine learning, which is a subset of AI. A machine learning system may evaluate enormous volumes of data and compare it to various entries to identify any irregularity in the pattern flow, which typically indicates an error. As more data is processed, machine-learning algorithms become wiser and can sometimes make judgments independently.

This ability to analyze large amounts of data also enables AI to assess broader industry trends and performance to assist particular businesses in making more accurate financial estimates. It can detect possible issues in the future, whether they are with suppliers, customers, or a specific team within your firm. This allows leaders to prepare for various scenarios so they aren’t caught off guard and can help mitigate the impact of disruptive events.

Blockchain

Blockchain, like AI, is a buzzword you’ve probably heard. Blockchain is a digital, distributed ledger that documents the movement and exchange of assets in great detail. It has no one central authority. A transaction cannot be changed once posted, lowering the risk of fraud. This establishes a clear chain of ownership, indicating who owns what and owes what, as well as where products are moved from raw material to end client.

Blockchain records can reduce the time and effort required to keep financial records and verify transactions before financial institutions settle them. When the ledger is updated to show that a client received products purchased from you, automatic, immediate payment to your firm may be made to you, saving you time and money.

Together, blockchain and AI might be able to audit every single transaction autonomously.

Integration of the app

As previously said, virtually all types of software are now available in the cloud. This comprises programs that cater to specific needs and are designed to be integrated with your accounting system and inventory and order management, payroll, and CRM systems.

While these connections are no longer as difficult or time-consuming to set up as they once were, there is still space for improvement. More applications will be developed in the future so that consumers can access their capabilities from within the accounting system. This eliminates the requirement for users to manually move data around and eliminates the need to switch systems regularly to accomplish various operations or find financial information.

With Cloud Accounting Software, You Can Work Smarter.

Established providers that offer cloud-native solutions — that is, systems created from the ground up to run in an as-a-service model rather than those simply rebuilt to run on distant servers — should be considered when choosing cloud accounting software. NetSuite, for example, is a cloud-based accounting and finance solution that extends beyond real-time financial data and ledgers to include support for numerous currencies, global tax compliance, automatic invoice payments, collections management, and more. NetSuite’s unified cloud platform is built on this accounting system, which contains complementing modules for planning and budgeting, revenue recognition, sophisticated billing, and more.

NetSuite’s ERP platform includes several cloud applications for related services such as inventory and order management, procurement, human resources (HR), and payroll, all of which are integrated with financials. These apps are natively connected with a common user interface, and all data is unified on a single platform, removing the need to switch between systems to handle various elements of your organization. NetSuite users automatically get new versions with essential updates twice a year as a SaaS solution, and they don’t have to worry about hardware or maintenance.

Cloud accounting isn’t just for the future; it’s something that organizations must implement right now to risk falling behind and losing market share. The advantages of a cloud accounting system are comparable to those of other cloud software. Still, they are even more critical because financials are the foundation of everything a company does. Operating a business without precise and current financial data is akin to driving a car without a speedometer or a fuel gauge. That’s why a cloud-based accounting system is an essential investment in today’s company world.

Frequently Asked Questions about Cloud Accounting

Q: Is it safe to use cloud accounting?

A: Cloud apps typically offer better data security than on-premises systems. To limit the risk of a fire or natural disaster, leading cloud accounting software providers back up Your Business’ data on servers installed in various locations. Employees are also less likely to transfer information via insecure techniques like flash drives because authorized users can access the system from any device, regardless of where they work.

Q: Is the cloud safe to use?

A: Many of the systems we use and the data we access in our personal and professional life are hosted on the cloud, and security procedures have risen in response. Top software vendors encrypt your data and utilize cybersecurity software to keep it safe. Your system is also password-protected; two-factor authentication is frequently used to offer an extra degree of security.

Q: Which businesses make use of cloud accounting?

A: Cloud accounting software is used by businesses across sectors, regions, and sizes, and many are starting this way. Everyone benefits from financials since they are important to every part of the firm.

Take a step!

Taking Your Business to the next step can only come to reality if you have the right expertise to deliver outstanding solutions. At Seibert Consulting Group, we specialize in delivering modern solutions to businesses that aim at taking full advantage of the eCommerce platform. We always customize our solutions to align with Your Business’ requirements and goals. Let’s start talking about your project and find out how we can help Your Business grow. Get in touch with us via our chatbot or email hello@seibertconsulting.com and via our direct line at 760-205-5440.